ABS has been «different from others» for over 30 years. A profile.

The business activities of Alternative Bank Schweiz PLC are dedicated to furthering the common good, humanity and the natural world. Founded in 1990, ABS now has the backing of 9'400 shareholders. It has total assets of more than 2.6 billion Swiss francs and over 44,000 customers. As a socially and environmentally responsible bank, it is «different from others» in that it does not set out to maximise profits, but instead lets itself be consistently guided by its ethical principles. This commitment is enshrined in the bank’s mission statement and articles of incorporation.

Customers’ money goes into long-term investments in social and environmental projects and companies. We publish a list of all loans to highlight what the money is being used to achieve. ABS applies the same rigorous standards to its investment business and employment conditions. It is committed to gender equality and operates without a bonus system. These are the ethical foundations from which ABS offers the standard services provided by an investment, savings and lending bank throughout Switzerland. We follow guiding principles and deliberately avoid investment banking, proprietary trading and stock market speculation that is detrimental to the common good.

Warning: Cyber fraud cases are on the rise!

With the digitalisation of payment transactions, it is becoming increasingly important to use digital payment methods such as e-banking, mobile banking, TWINT, and debit and credit cards responsibly and securely.

An alternative to conventional banks – with the common good in mind

Our business model and philosophy make us an alternative to modern-day conventional banks. We show society that it is possible to do business differently by putting our ethical principles before profits. That makes us alternative in the additional sense of “standing in opposition to the conventional”, particularly as regards the ethical justifiability of our actions.

Principles and clear guidelines direct everything we do. Our aim is to further the common good and have a positive impact on society and the environment rather than maximise profits. Nevertheless, ABS would not be able to survive if it did not make a profit. However, we only aim to make enough profit to drive the bank’s development in line with its own goals and to ensure the long-term viability of ABS’s alternative business model. We call it profit sufficiency.

Speculation for the purposes of earning the biggest possible profit in a very short time has no place in ABS’s investment policy. The Association for the Promotion of Ethics and Sustainability in Investment (CRIC) investigated the issue of whether stock-market trading is ethically justifiable in a study commissioned by ABS.

ABS also avoids proprietary trading and investment banking and the associated risks and returns. We focus on the real economy, not on finance. Our aim is to use the resources of a bank to help deliver socially and environmentally responsible products and services.

«Different from others» – with the usual services and securities

ABS is a bank for every day. In other words, we offer the same range of products and services as a full-service bank – from accounts for everyday payments to investment advice, mortgages and company loans. Just like every other bank in Switzerland, ABS is regulated by Swiss law and supervised by the Swiss Financial Market Supervisory Authority (FINMA). Again like every bank and securities broker in Switzerland, it is a mandatory signatory to the Agreement by Swiss Banks and Securities Dealers on Deposit Insurance and thus a member of esisuisse. Any money customers deposit with ABS is therefore secure up to an amount of CHF 100,000 per customer. Medium-term notes deposited with ABS in the depositor’s own name are also classed as deposits.

However, ABS attaches huge importance to transparency. This applies both to information on its own business activities, executive salaries (rather than just remuneration paid to committees, as is customary elsewhere) and critical examinations of its own actions (for example by means of external ethics audits). Transparency also means disclosing all loans that the bank awards so it is clear where the money that customers entrust to ABS is going.

What comprehensive sustainability means to us

environmental impact and are geared primarily to the real economy. Furthermore, it is crisis-resilient and generally able to flourish in the market. It is driven by long-term goals rather than by short-term success. In our view, any bank that simply minimises the negative social and environmental impact of its business operations and does not encourage positive social development and environmental regeneration is not sustainable.

You can find out more about how we measure comprehensive sustainability and use it to guide our actions here.

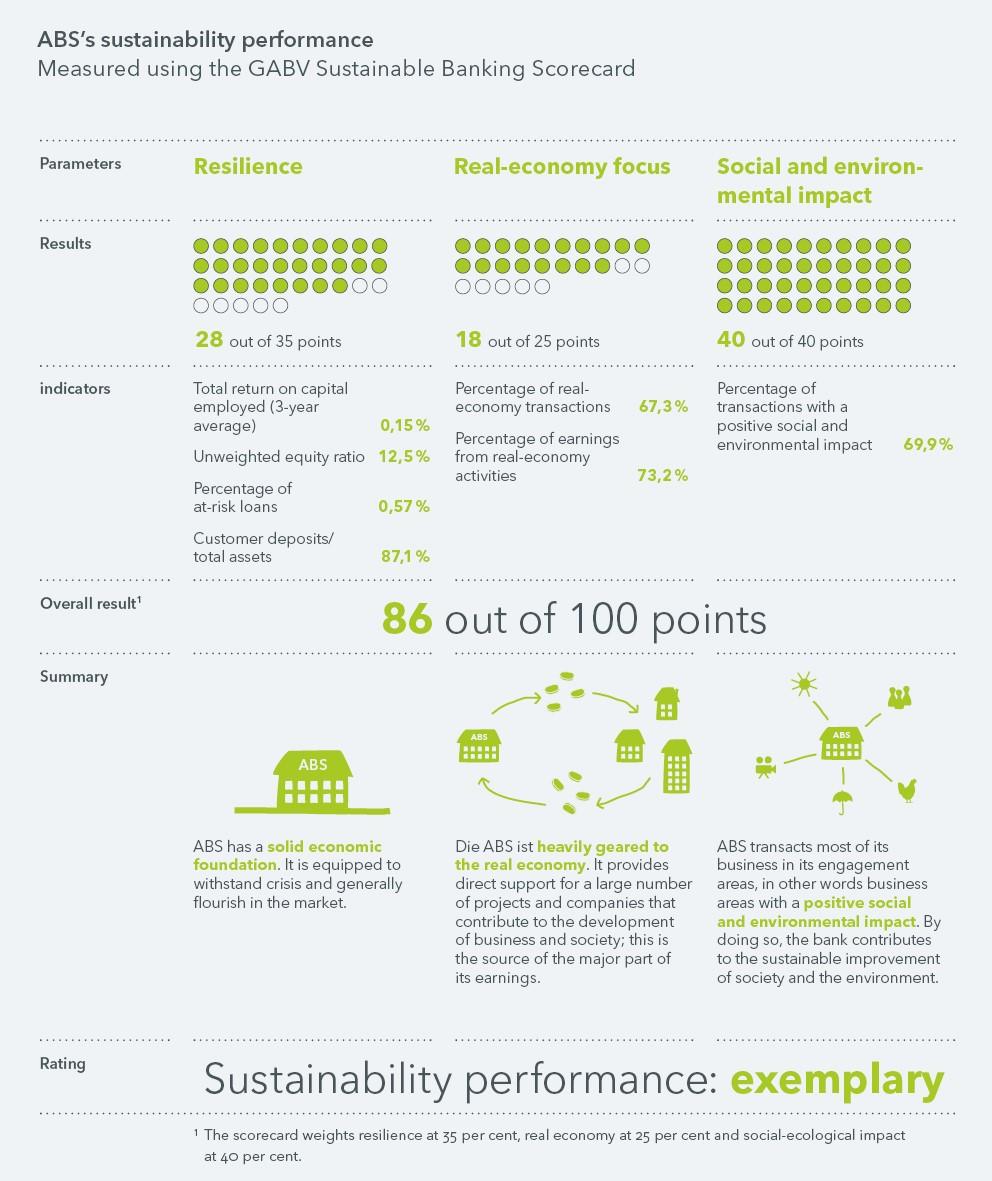

ABS provides a comprehensive measurement of its sustainability in its Sustainability Report. It reports five metrics:

- Resilience

- Real-economy focus

- Social and environmental impact

- Operational sustainability

- Climate impact

ABS has been reporting comprehensively on the climate impact of both its investment and financing (credit lending) activities since 2021 – making it, to the best of our knowledge, the first Swiss bank to do so. It is introducing steps in both areas to achieve net zero carbon dioxide targets by 2030. The results are published in the Sustainability Report.

Society and the environment: Focus on the real economy and social and environmental impact

ABS focuses primarily on real-economy impact. ABS defines the real economy as that part of the economy that manufactures and distributes real things such as products and services. Accordingly, real-economy focus indicates what percentage of ABS’s business activity directly supports the real economy.

Here it is ABS’s consistent aim to achieve a positive social and environmental impact. One of the ways it does this is by concentrating its business activities on nine engagement areas.

Employees: Equal opportunities and fair salaries with no bonuses

Comprehensive sustainability extends to our internal culture. For example, ABS offers employees non-gender-specific equality of opportunity. Part-time working and job-sharing are available at all levels up to executive management. There is a staff association for all employees and the association has a representative on the Board of Directors. Salary transparency and a «no bonus» policy are intended to strengthen commitment to fair salaries and intensify the focus on real-economy impact. The ratio between the highest and lowest salary has been set at a maximum of 1:5 and was transparently reported as 1:3.2 in 2020. An executive management with no chair reinforces the team mindset, while pilot projects on sociocracy strengthen personal responsibility and team spirit.

Business partners: Performance and values are important to us.

When choosing our business partners, we adopt the same principles that we apply to our credit lending and investment business. Using these as a basis, we have defined purchasing criteria. Not all the business partners we rely on can entirely fulfil our criteria. These include, for example, partner banks who assist with services that a small bank like ABS cannot provide on its own.

Operations: Constantly reducing resource consumption, sustainable buildings

ABS was the first Swiss bank to sign the “GABV Climate Change Commitment”. This commits participating banks to measuring and publishing the emissions resulting from their overall business activities by 2021 and to taking steps to reduce emissions in line with the pathway set out in the Paris Climate Accords.

Our Olten headquarters fulfil strict sustainability standards in terms of ecological construction and energy consumption. The building incorporates 2000 Watt principles in everything from its energy design to construction and materials choice and is certified to Minergie-P standards. It runs on green electricity and the toilets use rainwater. Sustainability criteria were even applied to our choice of office furniture. Furthermore, the site has good public transport connections. Since our Lausanne, Geneva and Zurich offices are rented, we have only limited influence on their ecological standards and energy consumption. Nevertheless, in addition to other factors such as cost and location, sustainability played a key role in our choices. For example, the Kalkbreite Cooperative, the building housing the ABS advisory services centre in Zurich, is an officially certified 2000-Watt site. At present, only seven sites in Switzerland achieve this standard.

Our key figures

Key figures at a glance:

Excerpt from the 2023 Annual Report

Excerpt from the 2022 Sustainability Report

Our organisational structure

The organisation chart shows ABS’s organisational structure. Executive management consists of a committee with no chairperson. There is a culture of flat hierarchies and employee participation throughout the bank. For example, employees have a seat on the Board of Directors through the staff association. We are currently working on forward-looking, agile organisation models that provide people with opportunities to develop their talents and lead to better and faster decisions.

You can find out more about the people who work at ABS here.